On Aug 15, 2016 India celebrated its Independence Day. It was an opportune day to ponder over the progress made by the seventh largest and second most populated nation in the world. During this introspection the author realized that the nation’s economic progress, especially the startups, would not have been possible without the momentum established by the 1991 economic reforms that brought freedom from the bonds of license raj, and gave direction to India’s economic growth story.

Until the 1991 budget, over 90% of the system was controlled by the state, free economy was non-existent and entrepreneurs found it extremely difficult to get clearances from the government in order to pursue their startup dreams. Rather than pragmatic action that was taken to stir up entrepreneurship and help founders of startups, the first set of reforms were implemented under compulsion, in order to avert a financial crisis and meltdown. The government was facing a fiscal and current account deficit. The oil shock of 1990-91 meant that India was paying more for the fuel, with exports falling. Despite borrowing from the IMF in that very year, India’s foreign exchange reserves had nearly disappeared, with just about enough dollars to meet the next three weeks of payments. There was a strong possibility of India defaulting on its international debt obligations. In order to pay its dues, reforms were kicked off with a three pronged strategy:

1. Fiscal Correction and Trade Policy Reforms – The food and petroleum subsidies were cut and fertilizer prices were raised by 40%. Import and excise duties were reduced. Rupee was devalued in two stages and controls on exports were eased.

2. Industrial Policy Reforms – Monopolies Restrictive and Trade Policies Commission (MRTPC) Act was repealed. Industrial licensing was abolished in all but 18 sensitive industries. Measures were taken to promote investments and competitiveness in domestic industries.

3. Public Sector Reforms – The banking sector was opened to participation by private sector. Securities and Exchange Board of India (SEBI) was converted into a statutory body and the office of Controller of Capital Issues was abolished. Reserve Bank of India (RBI) was given a more autonomous role in setting the interest rates and monitoring the money supply in the country.

The reforms enabled entrepreneurs to dream, to grow their nascent enterprises, to start organizations by exploring new sectors. Recalling those days, Uday Kotak, the chairman of Kotak Mahindra Bank, says:

I remember how, for days after the announcement, over long telephone calls on the landline, we analyzed every single element of the announcement: what it meant for the country, how industries would benefit, development of private sector, etc. When the significance of the announcement sunk in, that is when we realized how India as a nation was ready to take off.

Narayana Murthy, founder of India’s second largest software company Infosys, remembers that, “Once licensing was abolished, it allowed companies to make decisions in their boardrooms rather than in the corridors of North Block.”

As a result of the reforms, Sunil Mittal started the third largest mobile operator in the world – Bharti Airtel – and Subhash Chandra founded the Zee Television Network. By opening up India’s closed economy there was an increased sense of competition, and subsequently multinational corporations also entered the fray. Over a period of time homegrown startups such as BPL, VIDEOCON and Parle were competing with corporations such as Samsung, Sony and Coke/Pepsi. Although few of them survived to grow into large organizations, the first batch of homegrown Indian enterprises formed the key source of inspiration for founders in subsequent years.

After reforms brought success, and governments became bolder in maintaining the momentum of change. From 1999 to 2005, SEBI was made the single point nodal agency for guidelines and Indian firms were encouraged to acquire foreign corporations. Foreign portfolio investment for Indian companies was made more flexible with 74% foreign direct investment allowed in banking, telecom and 49% in civil aviation. As a result prominent Indian companies such as TATA acquired Jaguar, Land Rover and Tetley Tea in Britain. It also led to the emergence of new enterprises in the Indian aviation sector. According to Captain Gopinath, founder of India’s first low cost airline, Air Deccan: “Reforms take time to percolate down. The new middle class was emerging and so were people’s aspirations. I realized it’s not a country of 1 billion hungry people, but a country of 1 billion hungry consumers.”

Feeling empowered and confident of market conditions created by such policy measures, the timing from 2005 to 2016 was perfect for commencement of a startup revolution in India. Says Sachin Bansal, who started Flipkart, India’s biggest unicorn and e-commerce company,

When we started Flipkart in 2007, we began small by selling books. But we always had the goal of creating a consumer internet company that will be at par with the best in the world. This dream would not have been possible in a pre-liberalized India. Flipkart, I believe, is truly a child of liberalization.

More than twenty five years after initiation of liberalization, even though India finds itself ranked at 130th in “ease of doing business” by the World Bank, it must be remembered that Indian entrepreneurs’ endeavors have resulted in nine unicorns and the third largest startup ecosystem in the world. On 17 Aug 2016 Hike messenger has been valued at more than $1.4 billion and has joined the list of unicorns. The government has further introduced policy changes such as 100% Foreign Direct Investment (FDI) in food retail, civil aviation and 74% in private security agency and pharmaceutical businesses, a new e-commerce policy to govern online retailers, and GST (Goods and Services Tax). As a result more than 50% of Indian entrepreneurs feel that now is the best time to start and run a company in this country.

Source from: http://www.forbes.com/sites/krnkashyap/2016/08/23/indias-startup-success-comes-down-to-25-years-of-bold-economic-reform/#1ec974095c26

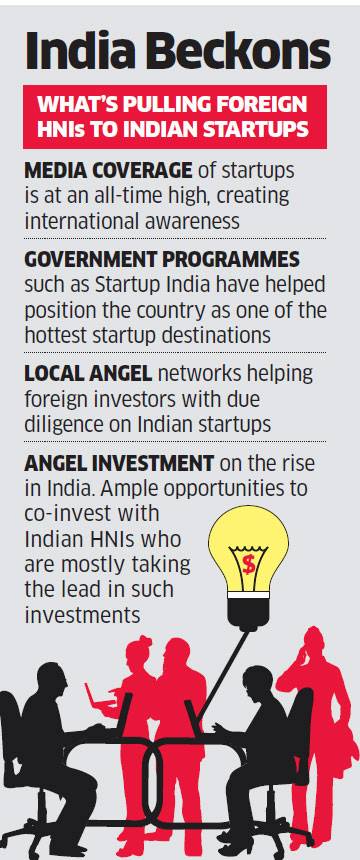

The Indian Angel Network, the country’s largest, estimates that over 20% of investors on its platform are based overseas, and this is only increasing. Foreign-based wealthy individuals are aware that India is one of the vibrant places for innovation, and they want a piece of the action for themselves, said IAN president

The Indian Angel Network, the country’s largest, estimates that over 20% of investors on its platform are based overseas, and this is only increasing. Foreign-based wealthy individuals are aware that India is one of the vibrant places for innovation, and they want a piece of the action for themselves, said IAN president